VAT Exemption

You may be exempt from paying the VAT if you match the HMRC criteria and sign a declaration confirming your eligibility. Goods that can be bought VAT free because of your disability include:

- Vehicle adaptations which allow you to drive

- Vehicle adaptations which help with accessing or exiting a vehicle

- Vehicle adaptations that help stow your wheelchair, powerchair or mobility scooter

- Mobility aids (Walking aids, Mobility Scooters, Wheelchairs etc)

- Specialist furniture and stairlifts

For any of these products to be sold without VAT a declaration must be signed stating

that:

- The vehicle must be substantially and permanently adapted

- The disabled person must use a wheelchair in order to be mobile (The usage of the wheelchair will vary depending on condition)

A copy of the VAT declaration can be found below:

Take a look at our extensive range of mobility aids.

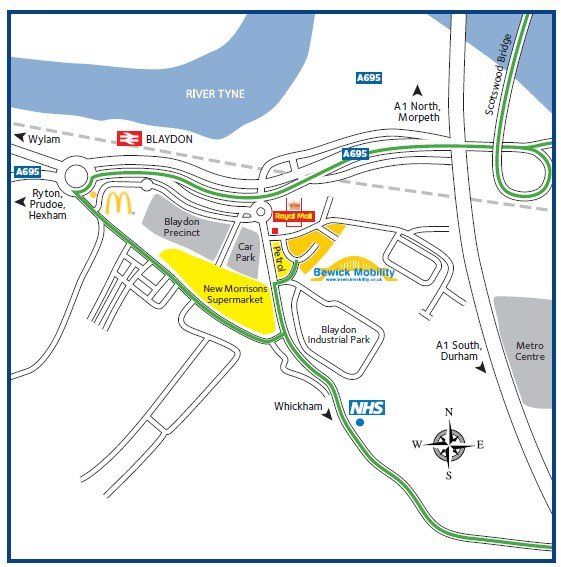

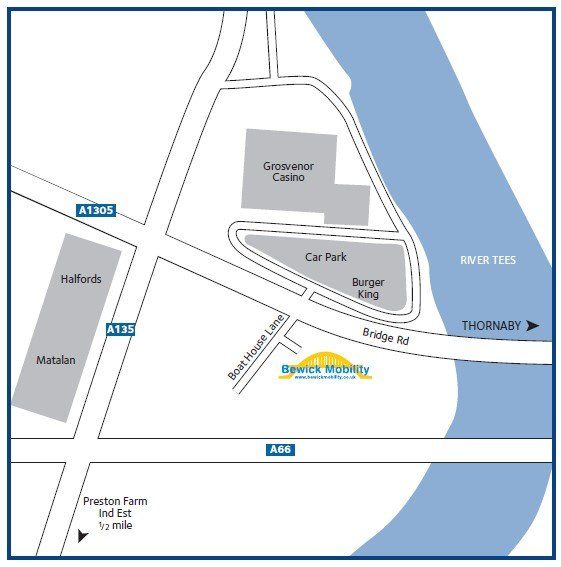

Visit our showroom in Blaydon-On-Tyne or Stockton on Tees.